SUPPORT. CONNECT. NETWORK.

The Women’s Business Alliance provides the small business community with a network of other small businesses to build and share information for positive growth. We encourage you to explore our website and contact us with any questions that you may have. Learn more >

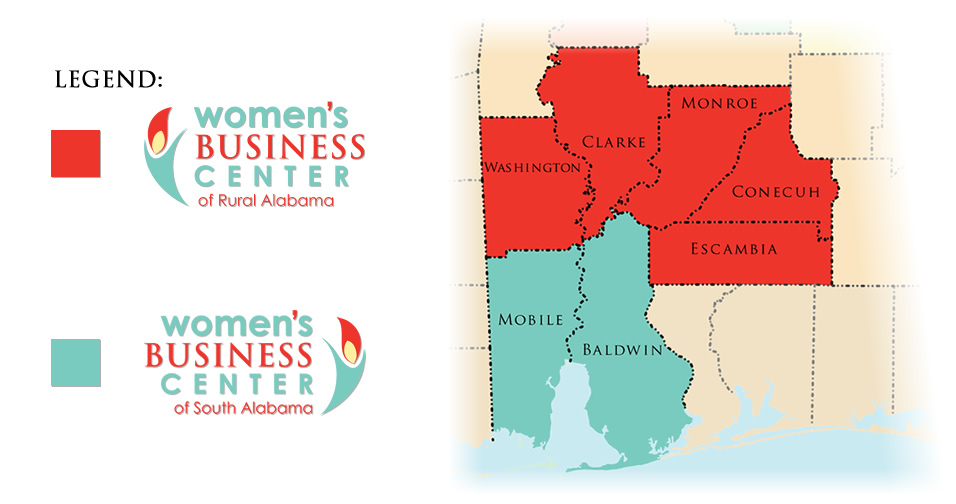

We serve women entrepreneurs in two regions. Select the county you or your establishment resides in to find resources near you.

In the United States, the legal minimum age for marriage is 18. However, exceptions are made in certain states for young people between 16 and 17 to marry parental permission. Thus, for teenage mail order brides, there are specific regulations and requirements that need to be taken into consideration.

Finding a Legitimate Website to Buy a Bride Online

The desire to have a family isn’t something unusual; however, finding the right partner can be a long and complicated process. Buying a bride online is a great option, but it can be difficult to determine which websites are reputable and which ones aren’t. A good place to start is to read reviews of sites, ask around, and look into their terms and conditions. Here are some additional points to consider.

Read Reviews & Ask Around

Take the time to read reviews from other people who have already bought a bride online. This is the best way to determine if a website is reliable or not. You should also ask family and friends who may have done this before. This can help you determine which websites are the most reputable and trustworthy.

Consider Costs & Terms & Conditions

Once you have identified a few reliable websites, take a closer look at the costs associated with purchasing a bride. Ensure that the fees charged are reasonable and that the terms and conditions are clear. Some websites may require you to pay for the bride up front, while others may offer different payment methods. Make sure you understand the terms and conditions before committing to a purchase.

Look at the Selection of Brides

After confirming the legitimacy and terms and conditions of a website, you should examine the selection of brides available. It’s important to ensure that the brides are appropriate for you and that you can build a strong relationship with them. Take time to review the profiles of the brides and make sure there are elements in common that could make for a successful relationship.

Are There Any Legal Requirements for Bringing a Foreign Bride to the USA?

If you’re looking to bring a foreign bride to the United States, there are certain legal requirements that must be satisfied. It can be a complicated and pricey proposition, so it pays to know the basics of how to make it happen.

Main step is obtaining a K-1 visa. This is also known as a fiancé(e) visa, and it allows the foreign bride to enter the United States legally. Applying for a K-1 visa involves submission of detailed documentation, as well as an interview at the U.S. Embassy in the applicant’s home country. Documents must include proof of identity, relationship, evidence of financial support, and a medical exam.

The K-1 visa has been issued, the foreign bride has a maximum of ninety days to enter the U.S. After arrival in the United States, the couple must marry within ninety days in order to for the foreign bride to stay in the country legally. The foreign brides in USA must stay married to the original petitioner for two years under a conditional green card to establish a bona fide marriage and avoid deportation.

After the two-year conditional period, the couple may apply for a permanent green card. This involves submitting proof that the marriage was real by way of documents such as bank statements or leases in both names, or birth certificates of any children, etc. Once the couple is approved, the foreign bride is eligible for full U.S. citizenship.

Bringing a foreign bride to the United States is not an easy undertaking, and the process can take many months, or even years, to complete. It is therefore important to make sure that all the necessary steps are followed and that all the paperwork is submitted correctly.

9 Countries Known for Their Gorgeous Foreign Brides

If you have been searching for your dream bride from a foreign land, we have just the list for you. These nine countries are known to be beautiful spots for gorgeous foreign brides, offering a wide selection of stunning women with captivating features and personalities. Let us take a look at each one.

Ukraine

The most popular places to look for foreign brides is Ukraine, which is renowned for its stunning and charming beauties. These Ukrainian women are very traditional and spiritual, but they are also modern and open-minded. Many of the women here are well educated and work in the business sector or other professional field.

Russia

Top destination for those seeking gorgeous foreign brides is Russia. Russian ladies are known for their strong family values and their beauty. It is important to note that Russian women do not like to be treated as objects or viewed as trophies. Therefore, if you are seeking a Russian bride, be sure to treat her with respect.

Brazil

Beauty place to look for stunning foreign brides. Women from Brazil are known for their vivacious personalities and incredible beauty. Brazilian women usually have dark hair and eyes, but there are also plenty of blondes and brunettes to choose from. When it comes to Brazilian brides, you can be sure they will be passionate and intense.

Colombia

Cool place to find gorgeous foreign brides. Colombian women are known for being outgoing, lively, and enjoyable. Many of them speak both English and Spanish, and some even speak other languages as well. Plus, Colombian women are passionate about their culture and traditions, so if you are looking for a bride who is proud of her home country, Colombia is the place to be.

Vietnam

Vietnamese women are known for being beautiful, elegant, and sophisticated. Many of these brides are well-educated and have an entrepreneurial spirit. They also value traditional values and marriage, so if you are looking for a traditional bride with a modern outlook, Vietnam could be the perfect destination for you.

Thailand

Paradise for those looking for gorgeous foreign brides. Thai women are known for their stunning looks and hospitality. Plus, Thailand is a great place to visit for your honeymoon, as the country has breathtaking beaches and incredible food. So if you’re looking for a memorable wedding and amazing experiences, Thailand should be at the top of your list.

Philippines

Another great choice for those seeking a gorgeous foreign bride. Not only are the women here stunningly beautiful, but they are also educated and family oriented. Furthermore, Filipino women have a deep appreciation for their culture, so if you are looking for a bride with a strong sense of identity and culture, the Philippines could be the perfect choice for you.

India

Home to many gorgeous foreign brides who are ready to marry. Indian women share some of the most beautiful features in the world, from their dark eyes to their beautiful hair. Also, Indian women are known for their intelligence and wit, so if you are seeking a bride with traditional values but modern outlook, India is the place for you.

Nepal

One of the most popular destinations for those seeking stunning foreign brides. The women of Nepal are renowned for their exotic beauty and captivating personalities. They are also very traditional and spiritual, which is why so many men are eager to wed a Nepalese bride. If you are looking for someone who is kind, gentle, and spiritual, Nepal could be the perfect place for you to find your dream bride.